How to Benefit from the Types of Financial Reports in Your Company?

- Posted by:

- Category: Uncategorized

In today’s business world, the types of financial reports are essential tools for understanding and evaluating a company’s financial performance. They are not merely a way to track revenues and expenses but represent a key to making strategic decisions. This article aims to provide a complete guide to these reports, highlighting their importance and how to benefit from them to ensure growth and sustainability.

What Is the Concept of Financial Reports?

The concept of financial reports refers to comprehensive documents that reflect a company’s financial performance over a specific period. They go beyond the basic financial statements to include extended analyses and detailed notes.

These reports are used by various stakeholders, such as investors, management, and government bodies, to make informed strategic decisions.

What Are the Main Types of Financial Reports?

The main types of financial reports include the following:

- Annual Reports: Offer a complete overview of the company’s financial performance over a full year.

- Quarterly Reports: Divided into four periods, these allow regular tracking every three months.

- Monthly Reports: Provide a quick summary of the company’s financial status.

- Income Statement (Profit and Loss Statement): Shows revenues and expenses for a specific period to calculate net profit or loss.

- Balance Sheet (Statement of Financial Position): Presents the financial position at a certain point, including assets, liabilities, and equity.

- Cash Flow Statement: Displays the company’s real liquidity status by detailing all cash inflows and outflows during a specific period.

- Statement of Shareholders’ Equity: Tracks changes in owners’ equity, including invested capital and retained earnings.

- Comprehensive Income Statement: A relatively new report that includes items of income and expense not shown in the traditional income statement.

This variety within the types of financial reports makes them indispensable for assessing a company’s financial health.

How Is the Preparing the Financial Report Done?

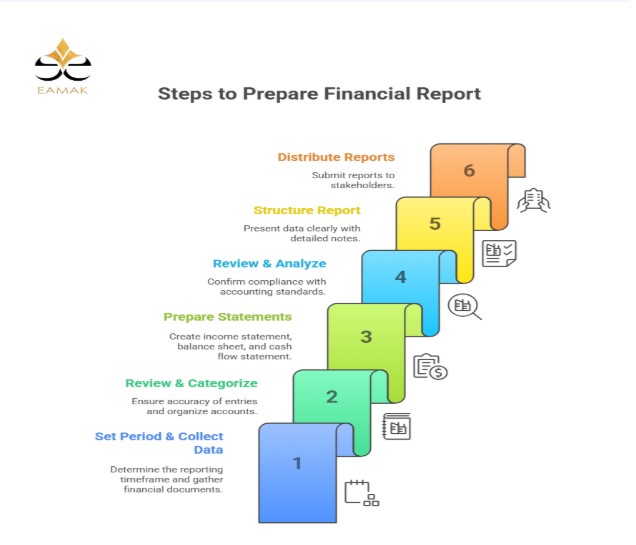

Preparing the financial report involves several organized steps to ensure the accuracy and clarity of the data presented. These include:

Preparing the financial report involves several organized steps to ensure the accuracy and clarity of the data presented. These include:

- Setting the reporting period and collecting data: Determine the timeframe of the report and gather all financial documents such as invoices and records.

- Reviewing account books and categorizing transactions: Ensure the accuracy of daily entries and organize accounts correctly.

- Preparing the main financial statements: This includes the income statement, balance sheet, and cash flow statement.

- Reviewing and analyzing the reports: Confirm that the data complies with international accounting standards.

- Structuring the final financial report: Present the data in a clear format with detailed notes that explain figures and assumptions.

- Distributing the reports: Submit the reports to stakeholders such as managers, investors, or regulatory bodies.

What Is the Difference Between Financial Statements and Financial Reports?

A frequently asked question in accounting is, what is the difference between financial statements and financial reports?

The answer is:

- Financial statements are formal documents like the income statement, balance sheet, cash flow statement, and equity statement.

- Financial reports, on the other hand, is a broader term that includes the financial statements as well as additional supporting information, such as auditor reports, board reports, tax filings, and documents submitted to banks for credit purposes.

Who Are the Users of Financial Reports?

The users of financial reports include a wide range of stakeholders, such as

- Internal management: For making operational and strategic decisions.

- Current and potential investors: To evaluate investment potential and possible returns.

- Creditors (banks and suppliers): To assess the company’s ability to repay debts.

- Regulatory authorities and tax bodies: To ensure compliance with legal obligations.

- Employees: To evaluate the company’s stability and future growth.

- Financial analysts: To provide assessments and insights on the company’s performance.

The types of financial reports provide essential data to these users, supporting transparency and confident decision-making.

The Impact of Exchange Rate Fluctuations on Financial Reports

The impact of exchange rate fluctuations on financial reports appears in how foreign currency-related assets and liabilities are revalued due to changes in exchange rates. This affects the balance sheet figures, as well as revenue and expenses from international transactions, which are reflected in the income statement.

Companies must disclose these effects in the report notes to provide a true and fair view of financial performance. This disclosure supports better risk evaluation, making it a key element of the types of financial reports.

Common Mistakes in Preparing Financial Reports and How to Avoid Them

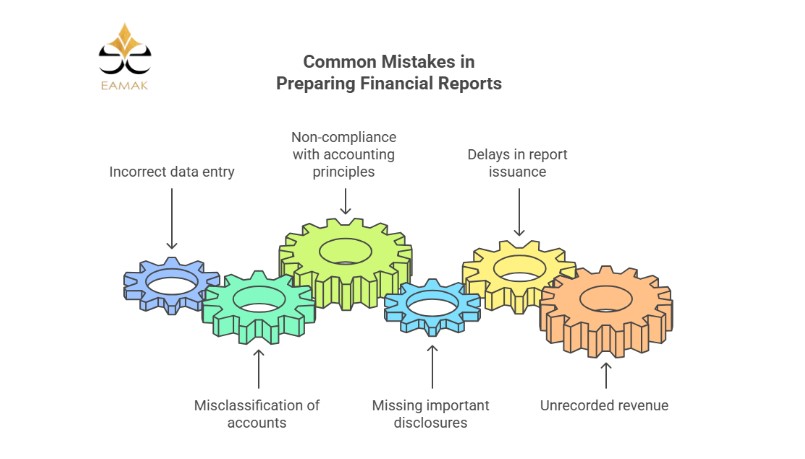

Avoiding mistakes in financial reporting is crucial for data accuracy. Common mistakes include

Avoiding mistakes in financial reporting is crucial for data accuracy. Common mistakes include

- Incorrect data entry: Avoided by careful review and using reliable accounting software.

- Misclassification of accounts: Ensure correct categorization of revenue, expenses, assets, and liabilities according to standards.

- Non-compliance with accounting principles: Avoided by following international accounting standards like IFRS.

- Missing important disclosures: Notes are essential for explaining key elements and should always be included.

- Delays in report issuance: Timely reporting supports better decision-making.

- Unrecorded revenue or misclassified expenses lead to inaccurate reporting. Regular audits and software tools help prevent these issues.

These mistakes can be avoided by training financial teams on the different types of financial reports, implementing a strong internal control system, and relying on certified accountants for regular audits. With this, we have outlined the common mistakes in preparing financial reports and how to avoid them.

Frequently Asked Questions About Financial Reports

Q: What are the main goals of financial reports?

A: To provide accurate and detailed information about a company’s financial performance, enabling investors, creditors, and management to make informed decisions.

Q: How often should financial reports be issued?

A: It depends on the company and regulatory requirements. The most common types are annual, semi-annual, quarterly, and monthly reports, all of which help offer continuous insight into performance.

Q: Which accounting standards should be followed when preparing financial reports?

A: Companies should follow international accounting standards like IFRS (International Financial Reporting Standards) or GAAP (Generally Accepted Accounting Principles) to ensure accuracy, transparency, and comparability.

Conclusion

In conclusion, the types of financial reports are vital tools for any organization seeking transparency and long-term growth. They support sound decision-making and help companies reach their financial goals.

If you’re looking to make accurate financial decisions based on professional reporting, Eamak is your trusted partner.

Our financial and business experts help you prepare and analyze various types of financial reports to improve your company’s performance.

Contact us today to begin enhancing your financial reports with confidence and expertise.