Did you know that 60% of companies that face sudden crises fail to recover within a year?

What if you were shut down tomorrow due to a supply chain disruption, a financial emergency, or even a rumor that ruined your reputation?

This is where risk and crisis management comes in as a lifeline that determines the fate of your organization’s survival or disappearance.

1- What is Risk and Crisis Management?

Have you ever heard of organizations that collapsed overnight due to an unmanaged crisis?

Risk and crisis management is the scientific art of combining pre-planning with smart response, to turn threats into opportunities, and protect your organization from the same fate.

- Risk management: A preventive process that aims to identify and analyze potential threats (e.g. market fluctuations, technical errors) to avoid their occurrence or minimize their impact.

Its tools: SWOT analysis, assessing the likelihood of risk, developing alternative plans.

- Crisis management: A reactive process carried out during or after a disaster (e.g. natural disasters, media scandals) to contain the damage and regain control.

Tools: Emergency operations rooms, rapid communication plans, reputation repair.

A thorough understanding of what risk and crisis management is will avoid unpleasant surprises and remember that the world is changing rapidly, and not having a plan means you’re already giving up. Don’t be a victim of chaos, be the creator of your crises before they create you.

2- The Importance of Risk and Crisis Management

Amid rapid economic and political shifts, organizations in Saudi Arabia and Egypt are facing unprecedented challenges, from market volatility to cyber risks, which increases the importance of risk and crisis management due to the presence of these challenges

Unique challenges in Saudi Arabia

- Accelerating digital transformation (Vision 2030) increases the risk of cyber breaches.

- Dependence on the oil sector exposes the economy to global price fluctuations.

Egypt’s pressing challenges

- Inflation and exchange rate instability threaten SMEs.

- Rapid population growth increases pressure on infrastructure and resources.

Common challenges

- Disruptions to global supply chains due to geopolitical crises.

- Climate change and its impact on the agricultural and tourism sectors.

- Difficulty attracting investments in light of fierce regional competition.

The Importance of Risk and Crisis Management

In light of economic volatility and unexpected threats, risk and crisis management becomes an imperative for the continuity of any organization. It is not just a paper plan, but a smart mechanism that turns challenges into opportunities and avoids losses that may threaten your presence in the market

The importance of risk and crisis management lies in

- Protecting reputation: It prevents unmanaged crises from tarnishing a brand’s image for decades.

- Saving resources: Early risk analysis reduces financial and human losses by up to 70%.

- Enhance resilience: Enables teams to make quick decisions under pressure.

- Attract investors: Clear crisis management plans increase shareholder confidence in your decisions.

- Forced innovation: Crises motivate you to develop unconventional solutions that give you an edge over competitors.

3- Risk and Crisis Management Strategy

In the fast-paced world of business, a risk and crisis management strategy is the shield that protects your organization from collapse

It’s not just a routine procedure, it’s a robust methodology that turns threats into opportunities and ensures your continuity despite the storms.

How do you tailor this strategy to fit your challenges?

- Periodic risk analysis: Identify potential threats (e.g., market fluctuations, supply chain crises) and assess their impact.

- Develop flexible contingency plans: Design rapid response scenarios for each potential crisis with team responsibilities.

- Continuous training: Organize crisis simulation workshops to ensure employees are prepared for any emergency.

- Real-time monitoring system: Use digital tools to track warning signs (e.g. customer complaints, price fluctuations).

- Transparent communication: Manage customer and employee expectations during a crisis through clear and direct channels.

- Post-crisis evaluation: Analyze the results and develop strategy to avoid repeating mistakes.

Successful organizations do not survive crises by chance, but rather thanks to a clear risk and crisis management strategy. Every smartly managed crisis adds a lot of experience and proves that you are able to survive.

4- Risk and Crisis Management Steps

In a world where challenges explode without warning, risk and crisis management steps are the only survival map for your organization

So how do you implement these steps professionally?

- Draw a risk map: Identify potential threats (e.g., financial crises, operational errors) and prioritize them based on the severity of their impact.

- Build contingency scenarios: Design flexible plans for each scenario (e.g., power outage, cyber attack).

- Clearly assign roles: Decide who will make decisions, who will communicate with the public, and who will handle technical operations during the crisis.

- Tactical training: Conduct real-life drills for your team to test plans and discover gaps before disaster strikes.

- Continuous monitoring: Use data analytics tools to detect early warning signs (e.g., declining sales, increasing complaints).

- Evaluation: After the crisis is over, analyze the team’s performance and develop plans based on lessons learned.

Success in the risk and crisis management steps does not depend on plans alone, but on speed and transparency in implementation.

5- Implementing Risk and Crisis Management

In an era where speed determines the fate of organizations, the application of risk and crisis management becomes the difference between success and extinction. Don’t settle for theoretical plans alone, it is smart implementation that turns crises into success stories.

So how do you apply this management in practice to ensure the continuity of your business?

- Utilize online platforms: Rely on tools like Risk Management Software to monitor threats in real time.

- Train field teams: Make sure employees understand their roles during a crisis through interactive workshops.

- Simulate worst-case scenarios: Run realistic exercises (such as data breaches or natural disasters) to gauge team readiness.

- Create a centralized operations room: Set up a centralized system to collect data and make quick decisions during a crisis.

- Proactive communication: Send regular updates to customers and employees through clear channels (such as email or communication platforms).

- Analyze the results immediately: After each crisis, collect data and optimize the application based on the errors discovered.

Risk and crisis management is not an option, it is an investment in your survival Every professionally managed crisis enhances your customers’ trust and proves that you are able to take all preventive measures before the collision, not waiting to fall into the trap.

6- ISO 31000 Risk Quality System

The Quality System for Risk is an international standard that provides a general framework and guidelines to help organizations effectively manage risks, whether financial, operational or reputational.

ISO 31000 does not impose specific policies, but rather guides you to design a flexible system that fits the nature of your organization.

Key principles

- Risk management is part of strategic decisions: it is not carried out in isolation from the organization’s objectives.

- Comprehensiveness: Consider all internal (e.g., employees) and external (e.g., laws) factors.

- Proactivity: Focus on preventing risks before they occur, not just dealing with their effects.

- Transparency: Sharing relevant information with all stakeholders.

Framework

- Design: Building risk management policies and defining roles.

- Implementation: Implementing the plan taking into account the organizational culture.

- Evaluation: Review the results and continuously improve the system.

ISO 31000 process steps

- Determine the context: Understanding the internal and external environment of the organization.

- Identify risks: Identify potential threats (e.g., market fluctuations, supply chain crises).

- Risk analysis: Measuring the likelihood of occurrence and impact.

- Risk assessment: Prioritize based on the results.

- Risk management: Choosing a strategy (avoid, minimize, transfer, or accept the risk).

- Monitoring and review: Continuously update the system to keep up with changes.

Advantages of the application

- Improved strategic decision-making.

- Enhance customer and investor confidence.

- Reduce unexpected losses by up to 40% (according to studies).

- Increase competitiveness in the market.

Conclusion

ISO 31000 is not just a technical guide, it is an organizational culture that transforms risk from a scary enemy to an opportunity for improvement.

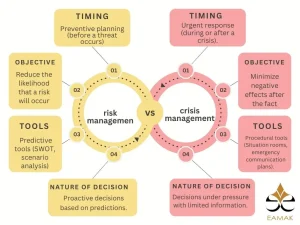

7- The Difference Between Risk Management and Crisis Management

Do you think that risk management and crisis management are two sides of the same coin? The truth is that confusing them can cost you dearly.

The former is built to prevent disasters, while the latter is implemented to contain the unpreventable.

So how do we differentiate between the two in the business world?

Timing

- Risk management: Preventive planning (before a threat occurs)

- Crisis management: Urgent response (during or after a crisis).

Objective

- Risk: Reduce the likelihood that a risk will occur (e.g., analyze data to avoid a financial crisis).

- Crises: Minimize negative effects after the fact (e.g., repairing a company’s reputation after a scandal).

Tools

- Risk: Predictive tools (SWOT, scenario analysis).

- Crises: Procedural tools (Situation rooms, emergency communication plans).

Nature of decisions

Risk: Proactive decisions based on predictions.

The end result

- Successful risk: Avoid the crisis altogether.

- Successful crisis management: Salvage what can be salvaged with minimal losses.

8- Crisis Management Plan

Did you know that 90% of companies without a crisis management plan fail to get back on track after a major disaster?

It’s not just a document that sits in a drawer, it’s an action guide that determines the fate of your organization at the first sign of danger.

So how do you build a plan that turns a crisis from a nightmare into an opportunity?

- Identify the team in charge: Select members with leadership and executive skills and define each individual’s role (e.g. decision maker, spokesperson).

- Draw potential crisis scenarios: Make a list of threats (security, financial, technical) and prioritize them.

- Establish emergency communication channels: Make sure you have a quick communication system with employees and customers (e.g. private messaging apps, group SMS messages).

- Set aside contingency funds: Have a portion of your budget dedicated to resolving sudden crises without interrupting day-to-day operations.

- Periodic training: Conduct realistic drills every 6 months to simulate crises and gauge team readiness.

- Immediate assessment mechanism: After the crisis is over, collect data and analyze the weaknesses to improve the plan.

A crisis management plan is not a guarantee that disasters won’t happen, but it is the only way to get through them with minimal losses

9- Common mistakes that ruin risk and crisis management efforts

You may spend a lot of money building a comprehensive risk and crisis management plan, but one mistake can bring it all down in an instant

What makes even the best-laid plans fail?

- Deliberately ignoring warning signs: Ignoring repeated customer complaints or declining sales could be a sign of a coming crisis.

- Not having a flexible contingency plan: Relying on just one plan with no alternatives leaves you paralyzed when that plan fails.

- Poor internal communication: Unclear roles between teams create chaos during a crisis.

- Rushed decision-making: Emotional reactions without analyzing data make things worse.

- Neglecting regular training: Theoretical plans without real-life exercises become .

- Not analyzing previous crises: Repeating the same mistakes because you didn’t evaluate your failed experiences.

10- Utilizing experts is a necessity in crisis management

Experts are an unbeatable secret weapon, so how do you make the most of their expertise to turn threats into opportunities?

When and how do you utilize experts?

- Before the crisis: When designing proactive plans or analyzing complex risks (e.g. a security assessment for a startup).

- During the crisis: When the challenges exceed the capabilities of the internal team (e.g., a data leak crisis that requires cybersecurity specialists).

- After the crisis: Root cause analysis and course correction.

The role of experts in analysis and solutions

- Provide an objective view without internal bias.

- Use specialized tools (e.g., crisis simulation models) to anticipate worst-case scenarios.

- Design customized solutions that fit the nature of the organization and its sector.

How do you build a network with experts?

- Establish strategic partnerships with consulting firms or specialized universities.

- Attend industry conferences and interact with experts through platforms like LinkedIn.

- Document past collaboration experiences in an internal database for reference when needed.

Experts are not a luxury, they are an investment in your organization’s intelligence. Every crisis managed with the help of experts leaves behind lessons that transform you into a wiser leader. Start building your network today before events force you to

11- How did organizations in Saudi Arabia and Egypt face their crises?

- A case study from Saudi Arabia: Drone attacks on Aramco facilities (2019)

The crisis: Drone attacks targeting critical oil facilities, causing a 50% drop in oil production.

How was it handled?

- Rapid response: Repaired damaged facilities in record time (less than two weeks).

- Proactive communication: Issued public statements explaining the extent of the damage and the recovery plan to reassure global markets.

- Strategic diversification: Accelerating Vision 2030 projects to reduce dependence on oil.

Lessons learned:

- The importance of having contingency plans for critical infrastructure.

- Transparency in crises maintains investor confidence.

- Case study from Egypt: The Ever Given ship grounding crisis in the Suez Canal (2021)

The crisis: The grounding of a giant cargo ship that disrupted global navigation, causing losses estimated at millions of dollars per day.

How was it handled?

- International cooperation: Using international experts and specialized equipment to refloat the ship within 6 days.

- Exploiting the crisis in the media: Turning the event into an opportunity to highlight the importance of the canal in global trade.

- Improving infrastructure: Announcing canal expansion projects after the crisis.

Lessons learned

- Cooperation with external parties can turn a crisis into an opportunity.

- Investing in continuous development prevents the recurrence of crises.

12-Technology and its role in risk and crisis management

In an era where minutes determine the fate of organizations, technology has become the eye that sees risks before they happen and the hand that holds the reins of crises, so how do digital tools turn threats into opportunities?

- Monitoring and early warning:

- Internet of Things (IoT) systems to monitor infrastructure (e.g. production lines, power grids).

- Artificial intelligence (AI) platforms that analyze social media data to detect rumors before they escalate.

- Remote sensing technologies to detect natural disasters (floods, fires) in Saudi Arabia and Egypt.

- Data analysis and decision-making:

- Machine learning tools to predict at-risk supply chains (e.g., global shipping crises).

- Crisis Simulation Models to test scenarios and choose the optimal solution.

- Platforms such as Power BI to turn complex data into visual reports that speed up decisions.

- Crisis management apps:

- Internal communication systems (e.g., Slack) to coordinate the efforts of teams during an emergency.

- Platforms to send mass customer alerts (SMS – Emails) in cases of security breaches.

- Using virtual reality (VR) to train employees to deal with virtual crises.

Technology has not eliminated crises, but it has transformed them from blind disasters to managed challenges.

Organizations that invest in digital tools not only survive, but emerge stronger.

Conclusion

In a world where challenges collide without warning, risk and crisis management remains the only guarantor of your organization’s continuity and prosperity. In this article, we discussed pre-planning tools, crisis containment strategies, as well as the critical mistakes that can ruin all your efforts.

Being well-prepared is not a luxury; it is the difference between those who rise from crises quickly and those who drown in their consequences for years.

Don’t wait until you have to deal with fire, start building your smart plans today

To turn these tips into a reality, contact Eamak to put you in touch with experts who specialize in designing customized risk and crisis management solutions.

Find out more by visiting our website Eamak and take the first step towards a better future for your business.