Your Guide to Preparing the Documentary Cycle

- Posted by:

- Category: Uncategorized

In the business world, the documentary cycle is one key element in ensuring smooth financial and administrative organizational processes. It provides an accurate system for recording transactions, which helps promote transparency, improve work efficiency, and minimize operational errors. Successful companies rely on an organized document cycle to facilitate the flow of information between different departments, leading to more accurate and data-driven decision-making.

Preparing the Documentary Cycle is the first step towards an integrated management system

Preparing the Documentary Cycle is a vital stage for any organization seeking to effectively organize its operational and financial processes. It requires establishing a clear structure for the path of documents from creation to archiving, with responsibilities and procedures for each stage. This process includes designing appropriate templates, defining flows and procedures, and setting up monitoring and follow-up mechanisms to ensure adherence to accounting and management standards. With a robust document cycle, organizations can improve financial control, reduce the risk of paper tampering, and enhance work efficiency between different departments.

What is a documentary cycle?

Startup owners often wonder What is a documentary cycle?

The documentary cycle is a series of procedures and steps that regulate the movement of documents within an organization, from their creation to their archiving. This cycle aims to document all financial and administrative transactions in an organized manner to ensure accuracy and transparency in managing operations. The documentary cycle includes several stages, such as recording data, reviewing documents, approving them from the competent authorities, and finally saving them for reference when needed. Through an effective documentary cycle, organizations can improve financial control, facilitate audits, and reduce operational errors, contributing to higher efficiency and business sustainability.

Types of documents in the documentary cycle:

- Disbursement documents: Includes payment orders and invoices.

- Receipt documents: Such as notes receivable and cash receipts.

- Inventory documents: Such as purchase orders and receipts for goods.

- Human resources documents: Such as payroll and incentive bonds.

The importance of the documentary cycle

The documentary cycle plays an essential role in the success of any organization, as The importance of the documentary cycle lies in its ability to regulate the flow of information within the organization, ensure the accuracy of financial transactions, improve administrative control, and enhance the efficiency of operational performance to protect the company’s assets.

Among its most prominent benefits

- Accuracy and transparency: The documentary cycle helps document all financial and administrative processes, reducing the likelihood of manipulation or errors.

- Improved financial control: By tracking and approving documents at every stage, it becomes easier to accurately monitor expenses and revenues.

- Facilitate audits and accounting: The document cycle provides an organized archive that facilitates internal and external audits, enhancing compliance with financial standards.

- Speed up workflow: By defining a clear path for documents, delays are reduced and processes within the organization are made more efficient.

- Minimize operational risk: Helps minimize the loss of documents or the loss of important information, keeping the business running efficiently.

- Increase the efficiency of resource management: The documentary cycle contributes to organizing the use of financial, material, and human resources more efficiently, reducing waste and enhancing productivity.

- Promote good governance and management: The documentary cycle ensures clarity of powers and responsibilities within the organization, helping to make well-founded decisions.

- Improved communication between departments: By flowing documents with a clear mechanism, collaboration between different departments is enhanced, minimizing administrative conflicts and increasing the speed of completion.

- Saves time and effort: Having a tight document cycle minimizes the need for random document searches or duplicate processes, saving employees time and enabling them to focus on more important tasks.

- Compliance with laws and regulations: The documentary cycle helps ensure that the organization is compliant with the required legal and accounting standards, protecting it from legal risks and financial irregularities.

- Facilitate analysis and planning: Documented documents provide accurate data that facilitates reporting and strategic decision-making based on real-time information.

By adopting an effective documentary cycle, companies can achieve a high level of organization, improving performance and making strategic decisions based on reliable data.

When conducting a financial audit, the documentary cycle is an essential reference for auditors, as all documents supporting the accounting entries are examined for compliance with accounting standards and financial laws.

The difference between the documentary cycle and the accounting cycle

They are often confused, so you should know The difference between the documentary cycle and the accounting cycle, each of which plays a different role in organizing financial and administrative processes within an organization.

Documentary cycle

The documentary cycle is the process by which financial documents are recorded, audited, and approved before they are entered into the accounting system. It includes a set of procedures that ensure the correctness and accuracy of financial information, such as issuing invoices, receiving payments, and preparing purchase orders.

The accounting cycle

It is the process that financial transactions go through within an organization’s accounting system, from recording transactions in the books to analyzing and classifying them, to preparing financial statements and final reports. Unlike the documentary cycle, which focuses on documenting transactions, the accounting cycle is concerned with analyzing recorded financial data and transforming it into useful accounting information. It includes stages such as:

- Analyzing financial transactions based on the documents that pass through the documentary cycle.

- Recording accounting entries in the journal.

- Posting entries to the ledger to group similar accounts.

- Preparing a trial balance to ensure that the balance between debtor and creditor is correct.

- Prepare financial reports such as the balance sheet and profit and loss statement.

Points of fundamental difference between them that can help in a deeper understanding of each and their role in an organization’s financial and management system:

- Focus: The documentary course is concerned with organizing and ensuring the integrity of documents, while the accounting course focuses on recording and analyzing financial data.

- Objective: The documentary cycle aims to document financial and administrative processes, while the accounting cycle seeks to measure financial performance and prepare financial reports.

- Temporal stage: The documentary cycle begins before the recording of accounting transactions, as it represents the basis on which accounting records financial entries.

- Inputs: The documentary cycle requires us to provide it with invoices, receipts, and purchase orders. Whereas the accounting cycle requires that we provide it with accounting data extracted from documents.

- Outputs: It gives us the results of documents that are ready for accounting use. While the accounting cycle gives results in the form of financial statements and financial analysis.

We can say that they have a complementary relationship, as the accounting cycle is completely dependent on the documentary cycle, as documents are used as the basis for all financial entries that are recorded in the accounts.

Without clear and accurate documents, accounting processes become unreliable and prone to errors and manipulation.

Therefore, it can be said that the documentary cycle is the foundation of the accounting cycle, providing the documents and information that are subsequently recorded and analyzed in the accounting system. Improving the efficiency of the documentary cycle leads directly to improving the quality of financial reporting and the accuracy of a company’s financial performance.

Using technology to optimize the document cycle

In light of technological development, many companies are relying on electronic systems to automate the document cycle, which contributes to reducing manual errors and improving data accuracy

Reduce manual errors and improve data accuracy.

Accelerate review and approval processes through e-signature and automatic auditing.

Save documents digitally for easy access when needed.

Enhance security and confidentiality through encryption and data protection systems.

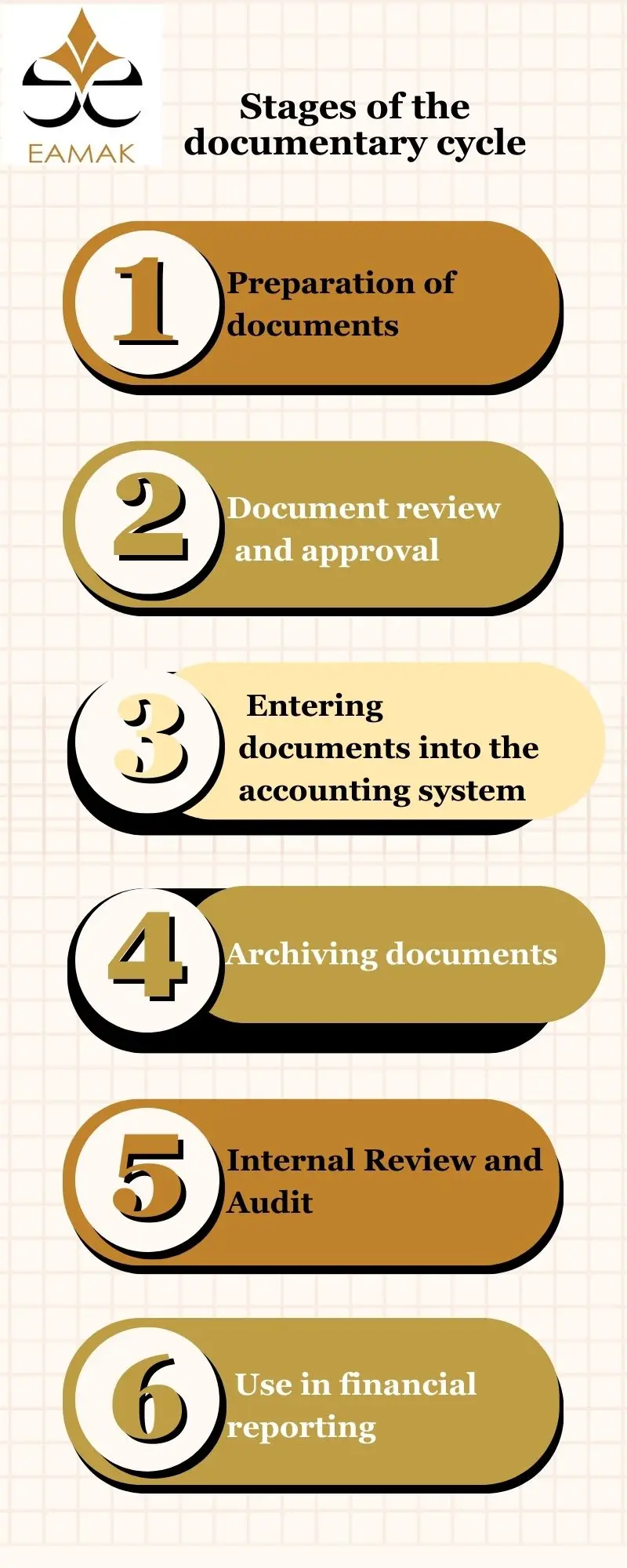

Stages of the documentary cycle

The documentary cycle goes through several stages to ensure that financial transactions are documented and validated before they are recorded in the accounting system. The following are the basic stages of the documentary cycle

The documentary cycle goes through several stages to ensure that financial transactions are documented and validated before they are recorded in the accounting system. The following are the basic stages of the documentary cycle

-

Preparation of documents

At this stage, financial documents that document the business and financial operations within the company are issued, such as:

- Sales and purchase invoices

- Receipts and disbursements

- Purchase orders and receipts

- Inventory documents and movements

-

Document review and approval

Before documents are recorded in the system, they are checked for correctness and conformity with internal policies:

- Review of basic data (financial value, date, parties involved)

- Approval by the relevant authorities (e.g. CFO or procurement manager)

- Ensure signatures and approvals are complete

-

Entering documents into the accounting system

After review and approval, the financial statements are entered into the accounting system:

- Preparing accounting entries based on the type of transaction

- Categorizing documents into the appropriate accounts (assets, liabilities, revenues, expenses)

- Posting the accounting entry to the ledger

-

Archiving documents

To ensure that financial records are preserved and can be easily referenced:

- Save documents electronically or on paper according to approved systems

- Organize documents into specific files and categories (e.g. vendor invoices, notes receivable)

- Determine the retention period according to legal regulations

-

Internal Review and Audit

This stage helps to ensure the accuracy of financial operations and detect errors or irregularities and includes:

- Conducting periodic reviews of documents and entries

- Reconciling data with monthly financial reports

- Ensuring compliance with accounting policies and procedures

-

Use in financial reporting

After all documents are recorded, their data is used in

- Preparing financial statements (e.g. balance sheet and income statement)

- Analyzing financial performance and making management decisions

- Responding to external audit or regulatory requests

The documentary cycle is an elaborate system for organizing financial processes within a company, starting with the preparation of documents, through reviewing and recording them and ending with auditing them and using them in the preparation of financial reports. Each stage ensures the accuracy and integrity of the data, helping to improve the efficiency of financial management and minimize errors and risks.

Sections of the documentary cycle

The documentary cycle is divided into several sections, each of which depends on the nature of the financial operations carried out within the company. This division aims to organize operations, facilitate control, and ensure accuracy in the recording of financial statements. The following are the most important Sections of the documentary cycle:

-

Procurement and Inventory Documentary Cycle

It includes all documents associated with purchasing and warehousing processes, to ensure that the required materials and services are obtained in an organized manner.

They include:

- Purchase order: The document that shows the needs of different departments for materials and services.

- Purchase order: A formal approval to execute a purchase from suppliers.

- Goods Receipt Notice: A document that shows the receipt and inspection of inventory.

- Purchase invoice: The document issued by the supplier for the goods or services supplied.

- Inventory Entry and Disbursement Bonds: Shows the entry and exit of goods from inventory.

-

Sales Documentary Cycle

It ensures that sales transactions are recorded accurately to keep the revenue flowing, and includes the following documents:

- Customer order: A document that shows the customer’s desire to purchase a product or service.

- Sales order: A formal approval to fulfill the order.

- Sales invoice: A document showing the details of the sale (quantity, price, date of sale).

- Delivery note: Confirmation of the customer’s receipt of the products sold.

- Bonds of receivables: Documents showing the collection of funds from customers.

-

Documentary cycle for expenses and payments

Organizes all payments made by the company, whether operating expenses or investments and includes:

- Disbursement requests: It shows the need for a specific department to disburse a certain amount.

- Cash disbursement vouchers: Documents the disbursement of funds from the treasury.

- Bank payment vouchers: Documents payments made through bank accounts.

- Expense reports: Shows the total expenditures made during a given period.

-

Revenue and Collections Documentary Cycle

Focuses on the processes related to collecting money owed to the company, and includes:

- Customer invoices: Shows the amount owed by customers.

- Notes receivable: Documents the receipt of funds from customers in cash or through the bank.

- Creditor and Debtor Notices: Used to adjust financial values between the company and customers.

- Customer Account Statement: A report showing the financial transactions between the company and customers.

-

Wages and Salaries Documentary Cycle

Organizes the disbursement of salaries and benefits to employees, and includes:

- Payroll: Shows details of employee salaries and other entitlements.

- Payroll vouchers: Documentation of payroll payments, whether in cash or through banks.

- Time and attendance records: Used to calculate salaries according to hours worked.

- Deductions and additions: Such as tax deductions, allowances, and bonuses.

-

Fixed Assets Documentary Cycle

It aims to organize the purchase, depreciation, and maintenance of long-term assets:

- Asset purchase authorization: Approval to purchase a specific asset.

- Asset Addendum Deeds: Shows the entry of an asset into the company’s records.

- Maintenance and repair reports: Shows the costs of maintaining an asset.

- Depreciation of assets: Records the gradual decrease in the value of an asset over time.

Conclusion

The documentary cycle covers all financial transactions within an organization from purchase to sale, and from expenses to revenues, ensuring transparency and accuracy in financial management. Categorizing documents into clear sections helps improve operational efficiency, reduce errors, and facilitate audits and accounting. Taking care of the document cycle is essential to the success of businesses.

If you are looking for effective solutions to organize your company’s document cycle and achieve the highest levels of accuracy and efficiency in financial management, Eamak Consulting is your ideal partner. Contact us today for a specialized consultation, and let us help you build a strong management system that ensures your success and sustainability.

Engy Adel

Engy Adel