In the world of business and finance, precise financial planning is essential to guarantee a company’s success and long-term sustainability. Create a Financial Plan for a Company is the foundation upon which investment decisions are made, financial resources are managed, and achievable goals are defined.

In this article, we take you on a practical journey to understand the nature of a financial plan, how to create one effectively, and we provide a simplified template to help you implement it with ease.

What Is the Financial Plan for a Project?

The financial plan for a project is a document that includes comprehensive estimates of revenues, expenses, and expected profits over a specific period, usually one year or more.

It also includes financial analysis of cash flows and the funding plan, offering the business owner or investor a clear future outlook of the company’s financial position.

This initial phase forms the foundation for understanding funding needs, investment opportunities, and future challenges. Without a clear financial plan, decisions can become random and expose the business to financial risks.

Now that we’ve answered “What is the financial plan for a project?”, let’s move on to the steps for creating a successful one.

What Are the Key Steps to Create a Financial Plan for a Project?

A financial plan cannot be created without following a well-thought-out and systematic approach. Among the key steps to create a financial plan for a project are the following:

- Define your financial goals: Does the company aim to expand? Increase profits? Reduce costs? These goals must be documented clearly.

- Estimate expected revenues: Based on the target market and predicted customer behavior.

- Calculate fixed and variable costs: This includes rent, salaries, raw materials, and operational expenses.

- Analyze cash flows: To determine whether the company can meet its monthly obligations.

- Set a risk and crisis management plan: To deal with market fluctuations or unexpected emergencies.

- Review and update regularly: Since markets and economic conditions are constantly changing.

By following these steps, create a financial plan for a company becomes achievable, built on real data and realistic goals. Regularly reviewing the plan ensures it remains suitable as market conditions evolve.

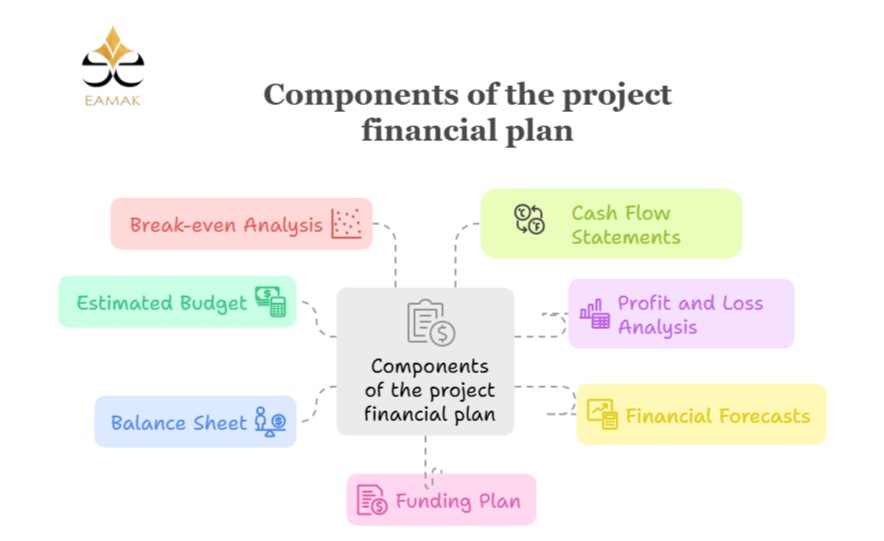

What Does the Project Plan Consist Of?

Many ask: “What does the project plan consist of?”

The answer: It consists of several interconnected components that cover the various financial aspects of a project. These include:

- Estimated Budget: An overall estimate of the total costs associated with the project.

- Profit and Loss Analysis: A report showing revenues and expenses over a specific time period.

- Financial Forecasts: These include expected revenues, profit margins, and cash flows.

- Balance Sheet: Outlines the company’s assets, liabilities, and equity.

- Break-even Analysis: Identifies the point at which the company begins to generate profit.

- Cash Flow Statements: Tracks the flow of money into and out of the company.

- Funding Plan: Specifies sources of funding, such as loans or external investments, and their related obligations.

Preparing a financial plan for companies should include all these elements to develop a complete financial vision that enables management to make informed decisions.

What Is the Financial Plan Template?

A financial plan template is a practical tool that helps entrepreneurs and financial managers organize financial data and accurately forecast outcomes.

The template typically includes the following tables:

- Financial Executive Summary: An overview of the company’s desired financial position.

- Monthly or Quarterly Revenue Table: Based on predicted sales or services.

- Detailed Fixed and Variable Costs Table: Including operational expenses and human resources.

- Monthly Cash Flow Projections: To determine liquidity levels.

- Projected Profit and Loss Analysis: Identifying potential profits and losses for the company or project.

When creating a financial plan for companies, using this template is highly recommended. It helps define different financial paths and allows for multiple profit and growth scenarios.

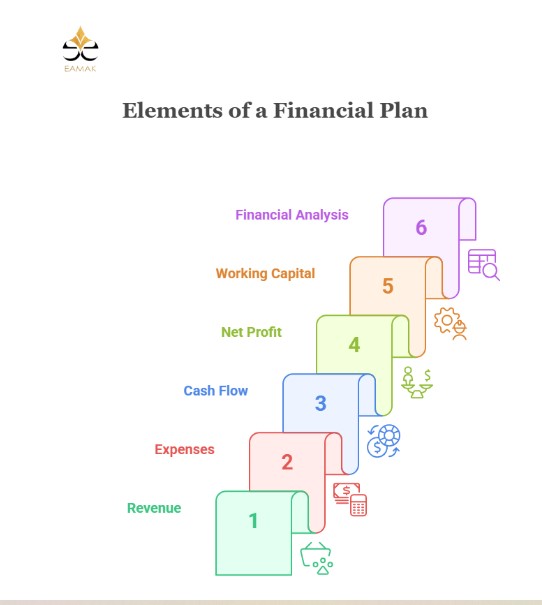

What Are the Elements of a Financial Plan?

What are the elements of a financial plan to pay attention to when creating a company’s financial plan? A financial plan includes a group of essential components that define the current and future financial state of the company. These elements include

- Revenue: The expected income from sales or services.

- Expenses: Costs related to running the business.

- Cash Flow: Monthly liquidity analysis.

- Net Profit: The company’s earnings after deducting expenses.

- Working Capital: Measures the company’s ability to cover short-term obligations.

- Financial Analysis: Used to evaluate performance indicators and profitability.

Each of these elements plays a key role in developing a successful financial plan for the company. It’s advisable to review these components with financial experts to ensure alignment with the company’s goals.

What Are the Benefits of Creating a Financial Plan for a Company?

The benefits of creating a financial plan for a company go far beyond improving financial efficiency. It also enables businesses to achieve their long-term strategic goals. Here are some of the main benefits:

- Clearly defined financial goals.

- Better resource management.

- Enhanced market competitiveness.

- Anticipation and planning for financial crises.

- Easier access to bank loans or investor funding.

A financial plan helps companies continuously monitor and evaluate financial performance, which increases the chances of growth and long-term stability.

Common Mistakes When Creating a Financial Plan

Despite its importance, many business owners make critical mistakes when creating a financial plan. These mistakes can weaken the plan’s quality and impact its effectiveness:

- Overly optimistic revenue forecasts without accurate market data.

- Ignoring hidden costs like maintenance or additional wages.

- Failure to set up a financial emergency plan.

- Not updating the plan regularly as circumstances change.

- Creating a plan that is disconnected from the company’s strategic goals.

Avoiding these mistakes improves the effectiveness of your financial plan and increases your project’s chance of success and financial stability.

FAQ

What is financial planning and the financial plan for a company?

Financial Planning: It is the process of defining the project’s financial goals and developing a strategic plan to achieve them by allocating resources, managing income and expenses, and forecasting cash flow.

The Financial Plan for a Company: It includes forecasting revenues, expenses, and profits; analyzing cash flow and break-even points, and creating a funding strategy to achieve financial sustainability.

What Are the Steps to Create a Financial Plan for a Company?

- Define financial goals (short, medium, and long term).

- Evaluate the current financial position (assets, liabilities, revenues, expenses).

- Prepare a budget and forecast cash flows.

- Analyze risks and set an alternative plan.

- Review and update the plan regularly.

What’s the Difference Between a Financial Plan and a Budget?

- Financial Plan: Offers a comprehensive vision of financial goals, revenue and expense forecasts, cash flow estimates, and project funding methods (company capital).

- Budget: A part of the financial plan that focuses on allocating income and expenses for a specific period (monthly or annually) and serves as a tool for financial control and performance monitoring.

- </li>

Conclusion

Create a financial plan for a company is the key to success for any commercial or industrial project. Through such a plan, companies can base their decisions on realistic data, reduce financial risks, and maintain a balance between income and expenses.

All you need is a clear vision, accurate data, and consistent execution.

Are You Struggling to Manage Your Finances or Build an Effective Financial Plan?

Eamak Financial and Administrative Consulting offers you the ideal solution through advisory services based on in-depth analysis and long-term market experience.

Our team of experts will help you create a financial plan tailored to your company’s goals, support your growth, and ensure business sustainability.

Contact us today for a consultation with our experts and take the first step toward a financially sound future.