Complete Introduction to corporate governance

- Posted by:

- Category: Uncategorized

Have you ever wondered how major corporations maintain their success and sustainability in the highly competitive business world?

The secret lies in corporate governance. In this introduction to corporate governance, we will explore how governance enhances transparency, attracts investors, and reduces risks—ensuring growth and sustainability. We will also discuss family business governance, so keep reading to discover the key principles of effective governance.

The concept of governance

Corporate governance refers to the system of rules and principles that guide and manage a company. It defines the relationships between a company’s management, board of directors, shareholders, and other stakeholders, including employees, customers, creditors, and suppliers.

Corporate governance provides a framework for setting corporate objectives, determining the means to achieve them, and monitoring performance.

Its primary goal is to balance the interests of various stakeholders while ensuring the company’s long-term sustainability and success.

The Organization for Economic Co-operation and Development (OECD) defines concept of governance as the framework of rules, relationships, systems, and processes through which authority and control are exercised in companies.

Similarly, the International Finance Corporation (IFC) describes corporate governance as the system through which companies are managed and controlled. It serves as the backbone of an organization, ensuring proper relationships between the board of directors, shareholders, and other key stakeholders.

The key principles of corporate governance include accountability, transparency, responsibility, and fairness, which encourage investors to invest. These principles also protect stakeholders, preserve shareholders’ rights, increase market value, and manage potential risks.

Advantages of corporate governance

After discussing the introduction to corporate governance, let’s explore its advantages:

After discussing the introduction to corporate governance, let’s explore its advantages:

1-Legal Compliance

Corporate governance ensures adherence to laws, regulations, and policies, reducing the risk of legal penalties and fines.

2-Better Management

A structured governance system facilitates efficient decision-making and goal achievement.

3-Increased Transparency

Transparency is one of the key advantages of corporate governance, as it ensures that all shareholders have clear insight into the company’s financial status and potential risks.

4-Attracting Investors and External Funding

Companies with strong governance gain a positive reputation and enhance brand credibility, making them more appealing to investors.

5-Boosting Investor Confidence

Transparency and sound financial management increase investor trust in the company.

6-Protecting Shareholder Rights

Governance safeguards shareholders from poor management decisions that could harm their investments.

7-Easier Access to Funding

Well-governed companies can secure financing at lower costs, enabling expansion and growth.

8-Economic Improvement

Strong governance contributes to financial market stability and attracts both domestic and foreign investments.

9-Risk Reduction

Establishing clear strategies and monitoring financial performance help minimize economic risks.

Implementing Corporate Governance

Implementing corporate governance can be effectively achieved through key principles and foundations, such as:

Establishing regulations to ensure the selection of the most qualified board members.

Granting the board of directors the authority to manage the company for the long term.

Defining shareholder voting rights according to their equity stakes in the company.

What are the most important practices that help in implementing corporate governance?

There are eight essential practices that support corporate governance implementation:

1-Appointing a CEO and setting long-term, sustainable goals, while monitoring their performance.

2-Developing corporate management to execute strategies that create lasting value under board supervision.

3-Preparing periodic financial reports to provide transparency on the company’s financial status.

4-Audit committee oversight, working with external auditors to review annual financial statements and assess internal financial controls.

5-Corporate governance committee supervision, ensuring a diverse board with expertise aligned to corporate goals.

6-Establishing a compensation committee to determine executive and senior management rewards based on performance.

7-Enhancing communication with stakeholders, ensuring transparency and educating them on financial cycles for greater returns.

8-Considering all stakeholders in decision-making, including customers, employees, and suppliers—an essential governance principle.

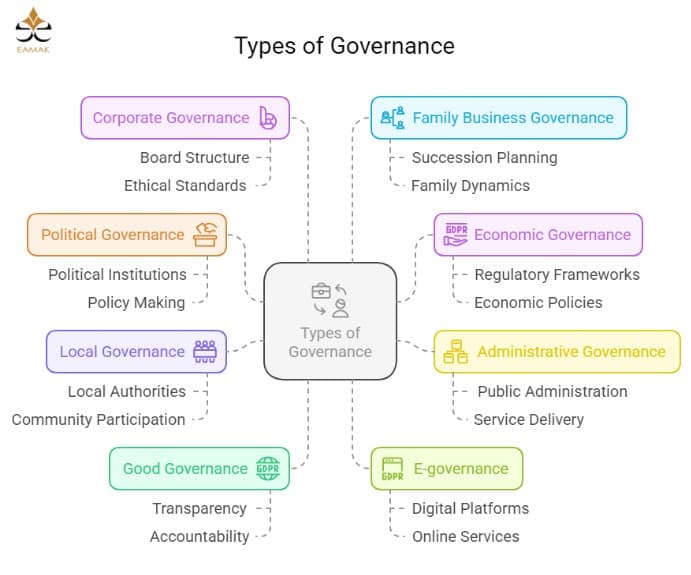

Types of Governance

There are several types of governance, each serving a specific function:

There are several types of governance, each serving a specific function:

1. Political Governance

This refers to the management of government institutions and decision-making processes. It involves power distribution, responsibility allocation, and ensuring justice and equality within society. The primary goals are political stability, social justice, and transparency.

2. Economic Governance

Economic governance focuses on the performance and regulation of businesses and financial institutions. It aims to ensure economic stability, sustainable growth, and fair market practices.

3. Administrative Governance

This type of governance applies to governmental and public sector organizations, ensuring efficiency and effectiveness in service delivery. It also aims to increase transparency and accountability in public administration.

4. Local Governance

Local governance refers to the management of municipal and community affairs. Its goal is to improve service quality and resource management at the local level.

5. Good Governance

Good governance ensures that government, corporate, and administrative bodies operate with transparency, accountability, and fairness to build trust and ensure ethical decision-making.

6. E-Governance

This involves using technology to facilitate governance services, improving transparency and accessibility for citizens.

7. Corporate Governance

Corporate governance defines the relationships between company management, shareholders, and stakeholders to ensure transparency, accountability, and strategic decision-making. We discussed this in detail in the introduction to corporate governance.

Family Business Governance

Family business governance refers to a set of standards and procedures aimed at organizing and managing family-owned businesses to ensure their continuity across generations while balancing family interests with business requirements. It seeks to enhance transparency, reduce conflicts, and promote sustainable growth for the company.

The Importance of family Business Governance:

Ensures the continuity of the company through smooth leadership transitions across generations.

Reduces family conflicts by implementing clear decision-making mechanisms.

Improves the company’s administrative and financial performance.

Builds trust among investors and banks, facilitating access to financing.

Key Elements of Family Business Governance:

- Clear Governance Structure: Includes an independent board of directors that balances the family and business interests.

Leadership Transition Policies: Mechanisms for selecting new leaders from within the family or appointing professionals.

Family Council: A forum for discussing family matters and their impact on the business.

Fair Compensation System: Ensures a balance between family members and employees.

Challenges:

- Balancing family interests with market demands.

Avoiding emotional influence in decision-making. - Securing leadership transitions without jeopardizing the stability of the company.

Consult with EAMAK experts today to ensure the sustainability and success of your family business across generations.

How Does Corporate Governance Improve Financial Performance?

Many ask: How does corporate governance improve financial performance?

The answer lies in efficient resource management and investor attraction, which provide companies with cost-effective funding.

To achieve this, companies must participate in financial markets and regularly disclose financial reports. This transparency increases investor confidence, enhances capital inflow, and boosts profitability—ultimately leading to improved financial performance.

Conclusion:

In this introduction to corporate governance, we discussed its role in improving financial performance, increasing profitability, reducing risks, and enhancing transparency—making companies more attractive to investors. Governance also strengthens management stability and shareholder protection, ensuring long-term growth.

For family businesses, corporate governance preserves sustainability across generations by structuring management and defining succession plans.

Whether you run a startup or a family-owned business, applying effective governance practices is the key to success and sustainability.

Get Expert Advice Today!

Connect with EAMAK experts for specialized consultations to help attract investors, enhance financial performance, and ensure the long-term success of your company.