Inventory pricing methods: A comprehensive guide to understanding different accounting options

- Posted by:

- Category: Uncategorized

Inventory pricing is a pivotal aspect of accounting and financial management for any organization operating in the productive or commercial sectors. Choosing the right Inventory pricing methods affects not only the financial statements but also the decision-making process, profitability, and cost control. In this article, we discuss the basic concepts associated with inventory and its pricing, the most popular methods, the characteristics of each method, and when it is appropriate to use them.

What is Inventory?

Let us first understand What is Inventory: it refers to the collection of items that an entity holds either for use in operational processes or for future sale. This includes raw materials, work-in-progress items, and finished goods ready for sale. The types of inventory vary depending on the nature of the organization’s economic activity. For example, in manufacturing entities, inventory includes multiple stages of production, while in trading entities, it is limited to finished goods.

Inventory is typically classified into:

- Raw materials: The basic materials used in production.

- Work-in-progress: Products that are still in the production process and not yet completed.

- Finished goods: Final products that are ready to be sold.

Effective inventory management ensures the availability of required products without excessive surplus that leads to capital being tied up or shortages that disrupt operational continuity.

What is Inventory Pricing ?

Now the question arises, what is inventory pricing?

It is the method used by organizations to determine the monetary value of materials or goods in inventory. This is a very important step in financial accounting, as the pricing method affects:

- Cost of Goods Sold (COGS)

- Profit or loss

- The value of inventory at the end of the period

- Accrued taxes

- Financial analysis

Inventory pricing is not only about determining the cost of purchase, but also includes accounting treatment when purchase prices vary, market changes occur, or there are heterogeneous products.

Product Pricing Methods

There are several product pricing methods that vary depending on the company’s strategy, the nature of the market, and the cost of production or purchase. In inventory pricing, product pricing methods are adopted to determine the cost per unit, thereby calculating profitability and the appropriate selling price.

The most popular product pricing methods include

- Full Costing: All direct and indirect product production costs are accounted for.

- Variable Costing: It is based on variable costs only and is used for internal analysis.

- Value-Based Pricing: The price is set according to the expected value to the customer and not just the costs.

- Competitive pricing: The price is set based on the prevailing prices in the market.

- Psychological Pricing: Used for marketing purposes to attract attention, such as pricing a product at 99.99 instead of 100.

Choosing the right way to price products depends on the organization’s goal: Maximizing profit? Gaining market share? Covering costs? These are all factors to consider.

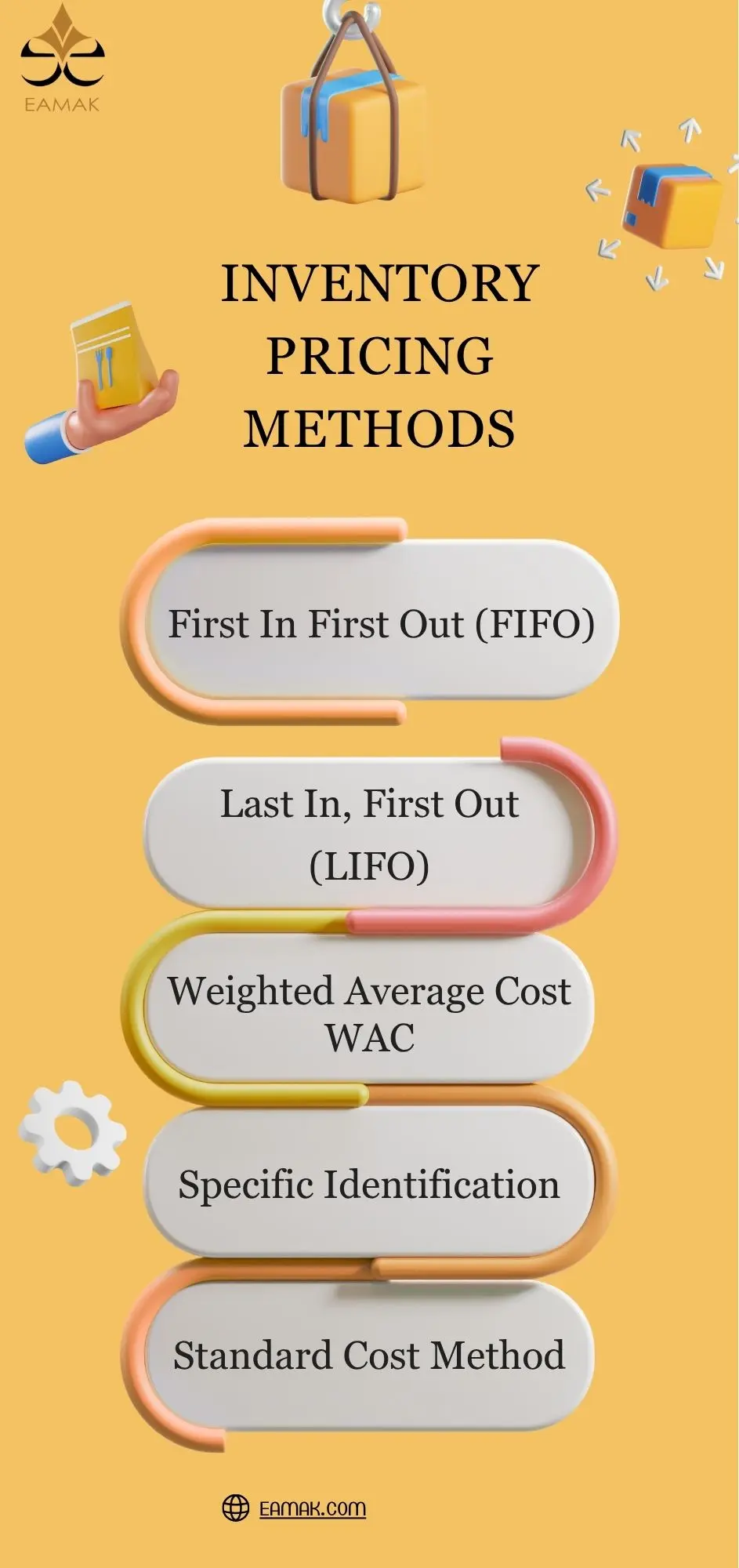

Inventory Pricing Methods

Inventory pricing is one of the most important accounting issues that must be determined when recording financial transactions. There are several well-known inventory pricing methods, most notably

1-First In First Out (FIFO)

The first quantities purchased are assumed to be the first to be sold. In the case of higher prices, this method shows higher profits and a higher inventory value.

2-Last In, First Out (LIFO)

The most recently purchased quantities are the first to go. In cases of inflation, this method reduces accounting profits and inventory value, which can help reduce the tax burden.

3-Weighted Average Cost – WAC

It is based on calculating the average cost per unit for all items in the inventory. It is often used in organizations where it is difficult to track each unit separately.

4-Specific Identification

Relies on tracking each unit in the inventory separately, allowing the exact cost of each item to be determined. This method is used in industries with high-value or low-volume products, such as automobiles or medical equipment.

5-Standard Cost Method

Expected or planned costs are used instead of actual costs. It is suitable for organizations that rely on a standard cost accounting system.

Each of these methods has a different impact on financial results and should be chosen in line with the nature of the activity and financial disclosure requirements.

Here is a breakdown of the top 4 methods.

1- Specific Identification Method

The Specific Identification method is one of the most accurate inventory pricing methods, as it links each unit of inventory to its actual cost. This means that each item in the inventory is tracked separately, from the time of purchase to the time of sale, and is recorded in the books at the actual cost paid during the purchase.

When is this method used?

This method is typically used in the following cases:

- High-value products such as cars, jewelry, medical equipment, or precision electronics.

- Relatively small inventory, where each item can be easily tracked.

- Companies operating on a Make to Order or custom order system.

Advantages of the Specific Identification Method

- High accuracy in calculating the Cost of Goods Sold (COGS) and inventory value.

- Provides very realistic financial information, as it relies on actual data for each unit.

- Very useful for profitability analysis at the product or individual sale level.

Disadvantages

- Requires advanced accounting and technology systems to track each unit individually.

- Not practical for large quantities or similar products.

- Can open the door for manipulation of profit or loss timing, if higher or lower-cost units are intentionally chosen for sale.

From an accounting perspective, the Specific Identification Method is considered to be the most realistic, but it is unsuitable for activities that involve large quantities or similar products.

According to IAS 2 – Inventories, this method is only allowed when the cost of each item in the inventory can be specifically determined.

2- First In First Out (FIFO)

The First In First Out (FIFO) method assumes that the first items purchased are the first to be sold or used. It is one of the most commonly used methods worldwide and often reflects the actual flow of goods, particularly for perishable items.

When is FIFO appropriate?

FIFO is suitable for businesses dealing with fast-moving products such as food, pharmaceuticals, or fashion.

It is also used when it is important to sell older inventory first.

Advantages of FIFO

- Provides a higher ending inventory value during periods of inflation because the most recent (and often higher) costs are left in the accounts.

- Reflects the natural flow of goods in most businesses.

- Generally accepted by international standards (IFRS) and local standards in most countries.

Disadvantages of FIFO

- During inflationary periods, it leads to higher accounting profits (because older, lower costs are recorded as COGS), which can increase the tax burden.

- Does not always reflect the current cost of replacing inventory in the market.

Impact on Financial Statements

- Profits: Higher than LIFO during inflation.

- Ending Inventory: Appears closer to market reality (as recent costs are left in the accounts).

3- Last In First Out(LIFO)

The Last In First Out(LIFO) method assumes that the last quantity added to inventory is the first to be issued or sold. This method is common in certain accounting systems (such as the United States under GAAP standards), but it is not permitted under International Financial Reporting Standards (IFRS).

When is the LIFO method used?

- When a company wants to reduce accounting profits during inflationary periods, it results in lower taxes.

- In industries where product quality is not affected by long storage periods, such as chemicals or metals.

Advantages of LIFO

- Reduces accounting profits during inflation, thus reducing tax liabilities.

- Shows the Cost of Goods Sold (COGS) at prices closer to current market rates.

Disadvantages of LIFO

- Not permitted internationally under IFRS standards.

- Ending inventory value may become unrealistic (since it is priced at older costs).

- Complexity in accounting occurs when comparing results over multiple years due to the buildup of older cost layers.

Important Note

Some companies that use LIFO prepare dual financial statements (LIFO for tax purposes, and FIFO or Weighted Average for international reporting).

4- (Weighted Average Cost – WAC)

The (Weighted Average Cost – WAC) method is based on calculating the average unit cost of inventory by dividing total costs by the total quantity purchased. Every time new inventory is purchased, the average is recalculated based on updated quantities and costs.

Calculation Method

Average Unit Cost = Total Inventory Cost / Total Number of Units

When is this method suitable?

- In companies that handle homogeneous products or items that cannot be easily distinguished (such as bulk raw materials).

- When the goal is to simplify accounting processes and reduce fluctuations in profits.

Advantages of WAC

- Simplifies accounting operations without the need to track each batch individually.

- Provides more stable financial results during price fluctuations.

- Permitted internationally under IAS 2.

Disadvantages of Weighted Average

- Does not always reflect the current cost of sold or remaining units.

- During price volatility, it may not accurately represent the financial reality.

Practical Example

If 100 units are purchased at EGP 10 each, and then 200 units at EGP 15 each:

Total Cost = (100×10) + (200×15) = 1000 + 3000 = EGP 4000

Total Units = 300

Average Cost = 4000 / 300 = EGP 13.33 per unit

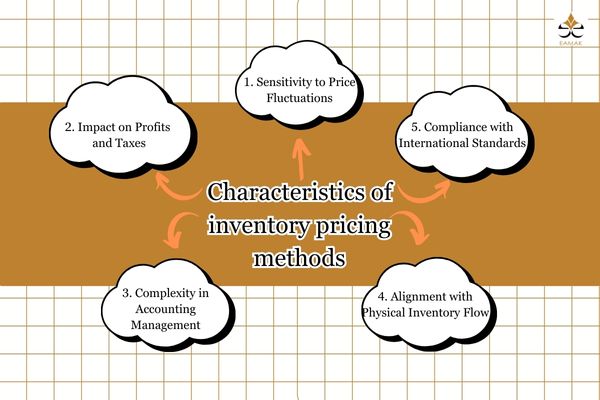

Characteristics of inventory pricing methods

Inventory pricing methods play a central role in determining the Cost of Goods Sold (COGS) and the ending inventory value, which are two essential elements for preparing accurate financial statements. The characteristics of these methods vary depending on the one used, impacting financial performance indicators, tax analysis, and cost management strategy. Below are the most notable shared and distinctive characteristics of the most common inventory valuation methods:

1. Sensitivity to Price Fluctuations

- Some methods, such as LIFO (Last In, First Out), are more sensitive to price changes because they rely on the most recent costs recorded. This causes COGS to closely reflect current market prices.

- In contrast, under FIFO (First In, First Out), the costs assigned to goods sold are less influenced by recent price changes, leading to higher accounting profits during inflation.

2. Impact on Profits and Taxes

- LIFO tends to lower accounting profits and, therefore, reduces tax liabilities during periods of rising prices.

- FIFO may result in higher profits and thus higher tax obligations.

- Weighted Average Cost (WAC) provides a more balanced and moderate impact during price volatility.

3. Complexity in Accounting Management

- Specific Identification method requires precise tracking of each unit in inventory, making it the most administratively complex.

- WAC is the simplest in terms of day-to-day accounting, as it does not require linking each sale to its specific cost.

- FIFO and LIFO require regular updates to inventory records after each purchase or sale, especially under the periodic inventory system.

4. Alignment with Physical Inventory Flow

- FIFO usually matches the actual flow of goods, especially for perishable items.

- LIFO may not align with the actual physical flow, but is used for accounting purposes.

- Specific Identification provides the highest level of accuracy when each unit is unique or high in value.

5. Compliance with International Standards

According to IAS 2 – Inventories, issued by the International Accounting Standards Board (IASB), the LIFO method is not accepted internationally, while the other three methods (FIFO, WAC, and Specific Identification) are permitted and widely used.

While US GAAP still allows LIFO, global companies tend to use internationally accepted methods to standardize reporting.

Inventory pricing methods and their impact on financial statements

The choice of inventory pricing method not only determines the cost of goods sold but also directly affects the main financial statements, especially the income statement and the balance sheet. Each method influences COGS, gross profit, ending inventory value, and net profit, making the accounting decision a strategic and financial matter.

1. Impact of FIFO on Financial Statements

Income Statement:

When using FIFO, older (and usually lower) costs are assigned to COGS, resulting in higher gross profit during inflation.

Balance Sheet:

The remaining inventory is priced using the most recent costs, reflecting a more realistic value for ending inventory.

Analysis:

This method may lead to higher taxes due to increased profits, but is useful in demonstrating strong operational performance.

2. Impact of LIFO on Financial Statements

Income Statement

Recent (and typically higher) costs are charged to COGS, resulting in lower profits during inflation and, consequently, reduced tax burden.

Balance Sheet

The ending inventory reflects older costs, which may be unrealistic compared to current prices, thereby reducing the book value of inventory.

Important Note

LIFO is not accepted under IFRS, but is still in use in countries following US GAAP.

3. Impact of Weighted Average Cost

Income Statement

Leads to balanced COGS, not necessarily reflecting the newest or oldest prices, resulting in moderate and stable profits.

Balance Sheet

Ending inventory is calculated based on the average cost, offering an acceptable middle-ground value that approximates market value.

Analysis

Useful in industries with small price variations or where price volatility is minimal.

4. Impact of Specific Identification Method

Income Statement and Balance Sheet

Delivers high accuracy in representing COGS and inventory value, as each unit is linked to its actual cost.

Suitability

Ideal for high-value or unique items, such as cars, jewelry, or medical equipment.

Financial Impact

Provides transparent financial results, though it may be costly in terms of accounting and administrative effort.

Conclusion

Inventory pricing is a critical accounting decision that directly impacts financial statement accuracy, performance analysis, and compliance with accounting standards. In this article, we reviewed the concept of inventory and its costing, as well as the fundamental differences between different inventory pricing methods, such as specific discrimination, first-in, first-out (FIFO), last-in, first-out (LIFO), and weighted average.

We also covered the characteristics of each method and its impact on elements such as cost of goods sold, accounting profits, and ending inventory, as well as its impact on financial reporting and tax strategies. An in-depth understanding of these methods helps organizations choose the most appropriate policy that matches the nature of their business, reporting requirements, and market volatility.

As international accounting standards evolve and legislation differs from market to market, there is an increasing need to adopt a flexible analytical approach to inventory pricing that considers both financial and operational aspects.

Understanding the impact of inventory pricing methods on financial performance and making the right accounting decision requires a thorough knowledge of the market, tax regulations, and the nature of the business.

If you are looking for a specialized analysis and pricing structure that reflects the reality of your operations and supports your company’s growth, the expert team at Eamak Management Consulting offers professional support.

Whether you’re operating in the Egyptian or Saudi market or looking to expand into new markets, contact us today for a consultation based on accurate data and an in-depth understanding of your needs.